The Curious Case of the Florida Venture Environment

A Dive Into The Tech Industry's Recent History in Florida

I have a strong love and hate relationship with Florida. At its best, Florida is home to astounding nature, warm people, low taxes, and Publix Supermarkets. I have always been a fan of the bars, beaches, and bath salts that the state offers. Economically speaking, I believe it's one of the most criminally underdeveloped states in the country. From a bustling tourism scene, sans pandemic, and a gateway to many worlds- it was never lost on me the state's potential for greatness.

In the context of tech and corporate history, some of the most tragic Florida stories come from a place that is now known for wealthy New York City snowbirds, and a single from Bas and ASAP Ferg. The famed Entry Systems Division was the IBM PC's birthplace in Boca Raton, FL, and its burial site. Bill Gates notoriously negotiated the deal with IBM that forwent Microsoft's claim over royalties on DOS to maintain the ability to license DOS to other companies. Gates understood that the OS layer and abstracting the hardware would be the rightful platform where software would live. IBM was unable to foresee other OEMs would serve to commoditize the PC market. In ways that would threaten its 4.6 Billion dollar ARR business (Around 11.5 Billion in 2020 dollars), it agreed to that deal and sunk Boca Raton's future when pen went to paper.

Over time, as it became clear that the knowledge centers of computing would coalesce in Boston, New York, and Palo Alto- IBM winded down its business operations in research and development and ordered its leadership to move to New Jersey in 1986. Down the line, the manufacturing center that made the PCs would be offshored. Likewise, the United States would deprioritize research and development for the space program leading the space coast and Cape Canaveral to have its best years behind it.

All was not lost; Florida would later serve as the home of Citrix Systems, founded by an IBM Alum, and would receive investment from KPCB. Today, it still exists as one of Florida's largest tech employers and would become one of Sen. Loeffner's covid stock picks. As the inklings of an internet era dawned upon us in the 90s- only a few small internet companies would form and crash in the dot com bubble. And then, in the wake of 2000, would only have a few small offices to hedge against the increasingly expanding costs of employing software engineers while also hosting Latin American operations for US-based tech giants.

I grew up on the edge of the Redlands; whenever I would head to Camp Matecumbe (home of the Pedro Pan airlifts) to chaperone my mom at work- we would drive past the Alienware campus nearby. I thought the very best technology came out of that design center to my young and untrained mind. Possibly so for prebuilt gaming computers (Micheal Dell felt fit to acquire he company), but Miami and much of Florida would mostly focus on other industries missing the third wave of technology companies primarily located in Seattle or California.

I spent much of my short life so far figuring out why Florida missed out on the massive wave of technology growth. For internet industries praised for increasing access to technology- unfortunately, much of the wealth accumulated to one area. It's understandable why; California non-compete laws favor worker mobility allowing new companies to take advantage of knowledge learned by the worker sharing insights. Besides, the UC system became home to many pioneering computer advancements that only fed into the Fairchild Semiconductor flywheel. But now, when the political operators of that area seemingly don't understand how to maintain that growth nor want to handle it responsibly. As such- many diatribes from many people arose as people consider alternatives to the Bay Area.

In 2019, I felt that the cost of living in "winner take all cities" would hamper growth for new startups. It would serve as a plateau of innovation for many up and coming operators and founders. The jury is still out on whether today's industrial towns would always remain. There are strong bull cases as to why many of the existing startup centers would stay despite the Trump administration's opportunity zones that provide seemingly good tax benefits for building businesses in the middle of nowhere. One can't help but acknowledge that a fair city that speaks its inhabitants' language would foster new and lucrative beginnings. My initial thesis was rebuffed by Elad's response about industry towns that put a block I couldn't quite think around when it came to the economic development where it wasn't a cities' core competency. Then Covid happened.

So it comes as no surprise that Founders Fund partner and serial entrepreneur Keith Rabois is moving to Miami. I think Miami is a fantastic choice, with warm weather all year round, an ample amount of Barry's locations and sound real estate conditions compared to other cities. With that announcement, I got a flurry of messages asking me- why Miami, or why Florida?

I was active in the local tech scene when I was in high school and undergrad. I witnessed the exciting cross-section of government lobbying, tech companies debating to open an office, and engaging companies to sponsor events and recruit students from Florida, so this is one of the few topics I can speak with authority on.

Let's start with where Florida falls short.

Ecosystem That Caps Upside

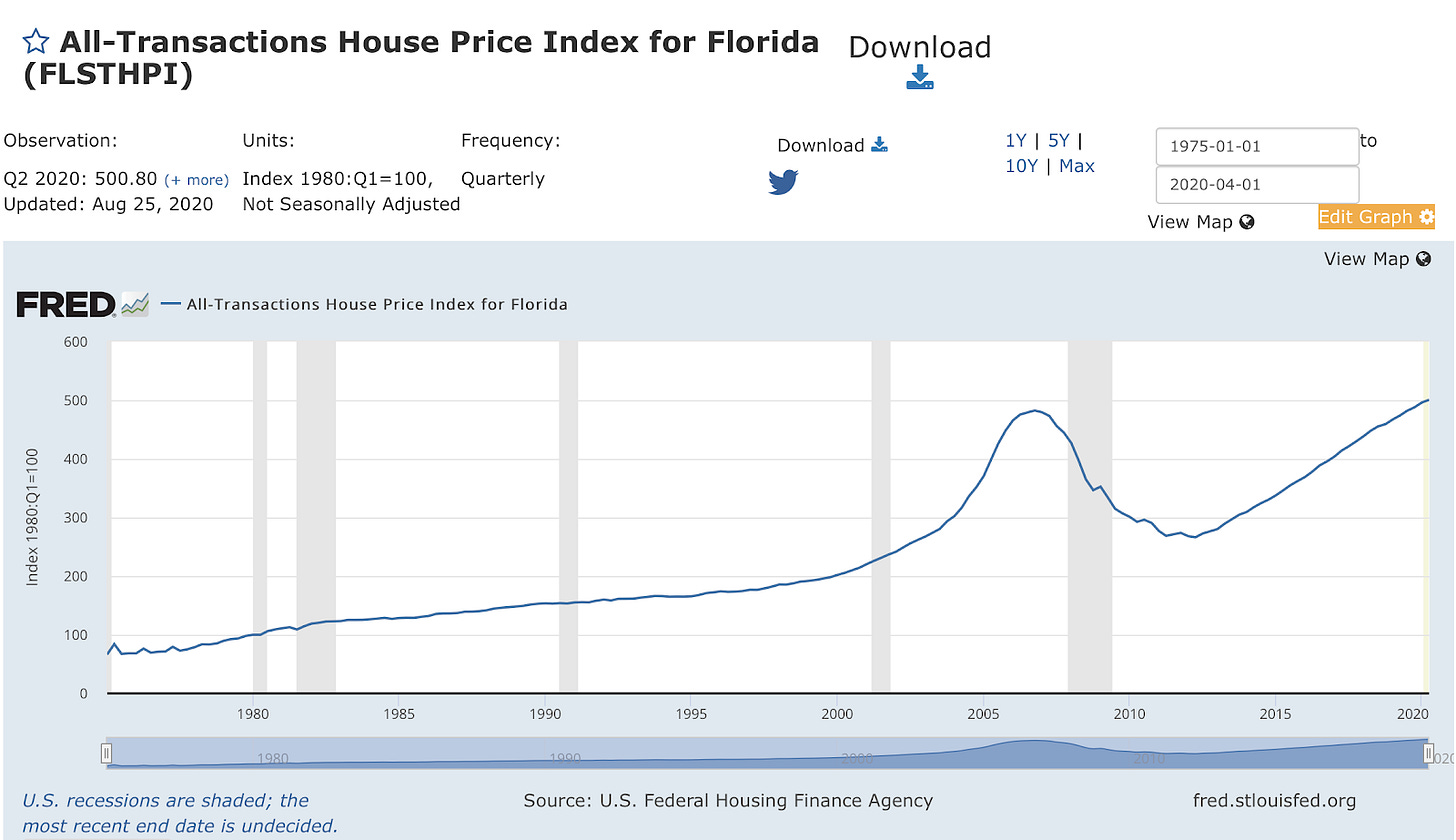

The money in the state doesn't know the Venture asset class well. During the 2008 financial recession, one of the United States dollar's saving graces was its ability to buy massively depressed Dollar-denominated real estate assets.

In contrast to the rampant growth of the BRICS countries minting new millionaires by the month, wealthy individuals wanted to hedge against local currency weakness. As a result, around the start of the decade in 2010, many private real estate investors started buying defaulted real estate assets selling them to BRICS-based HWIs. As a result, the high net worth individuals who saw angel investing as a new kind of craze don't know how to operate in this environment.

This runs into a few problems for companies who want to get local investors; the term sheets are usually poor. I recall a pitch event in 2016 only having seven firms that only were able to write checks at the pre-seed to A level. And I can safely assume they did not have the network to provide value to their founders. They also made no investments in any of the companies presented at the event.

While I was attending undergrad, I wasn't very knowledgeable about the venture space and noticed that pay to pay angel syndicates were rife in the state. I thought this was normal! The healthy environment started to change in 2019, where firms capitalized on Latin American companies' potential to have a US HQ in Miami. Still, I don't believe this has translated into a meaningful deal flow for other Florida metro areas like Tampa, Orlando, and Jacksonville.

From a cursory analysis, of those who lost their primary residence in Florida and who made the 2019 Forbes billionaire list- only 4/52 of them made their wealth from technology. Many tax benefits being a primary resident of Florida provides over others, no state income tax. In particular, Keith is said to have around 7 percent of Affirm, which is about to go public. California has a 13.3 percent tax on capital gains, whereas Florida has no taxes on income, therefore no capital gains taxes.

Most states and regional corporate development non-profits, for lack of a better word, fall into a trade-show syndrome. I feel the same applies to Florida- if you were to walk into the Florida Venture Forum, it felt like I was taken into what it would be like to raise money in 2005. Top tier and extremely ambitious firms understand that branding and signaling is key to attracting deal flow. The same applies to university accelerators; the culture of aggressive growth isn't in these entrepreneurship centers where they might produce profitable businesses, but they aren't good venture investable businesses. As a result, the area suffers, the economic output of an area increases when there are enough wins to mint more millionaires who will start their businesses. For all of the flack that San Francisco gets, everyone there speaks the same language and jargon in the same way Los Angeles is "the" place to get noticed. However, unlike capital operators, developing acting talent requires higher marginal costs, and it isn't something that can't be overcome.

Outsourced Product Development That Slows Iteration Speed

From my conversations with founders in Florida, one of the most significant barriers I see is that they would have a unique insight on the market and would like to test that hypothesis, but they have obstacles to execution. Many of the founders aren't technically minded or lack the requisite connections to facilitate growth. To be clear, I am describing founders who should know how technical products are made. It's an all too familiar story where hiring a software consultant to develop your MVP goes awry. Those who fail to articulate their product requirements are going to get substandard results. Keep in mind; startups need to iterate quickly or nail their "movie production" to a T. Outsourcing development where you are unaware of how your product is built is likely to produce suboptimal results.

Brain Drain

Florida is losing its skilled graduates at a faster rate than it can keep them. Some excellent state schools in the state are more affordable and produce the same outcomes as their Top-10 CS counterparts for fractions of the cost. However, Floridian taxpayers are subsidizing New York and the Bay Area's growth due to the better opportunities on the opposite coast. Speaking on behalf as a former student leader at FIU and a hackathon founder, I am partially guilty of this. I courted Facebook's first campus engagement leading to a steady pipeline of students making more money than their parents did five times over. One of the highest paying software firms in the state: Ultimate Software usually pays $80,000 a year, which is very comfortable in the state but doesn't compare to companies that are very generous with equity compensation. For graduates of UCF or UF, usually, local options don't reach as the local jobs are mostly defense contractors or medium-sized businesses.

It's somewhat baffling because UCF and Embry-Riddle produce the most Aerospace engineering graduates.

I do feel that with the rise of remote companies, there will not be as much as an issue tied to explicitly hiring locally based developers or operators. It remains to be seen if it would remain an issue as before in a pre-covid landscape. (I don't want to wade into another remote working vs. co-located argument)

Bright Futures

I don't criticize my home state out of malice but out of deep care for everyone who has decided to build their careers here. I want readers to know that I have as much skin in the game as anybody in this argument.

What led me to start my career here was the chance to be close to family and the potential. Much of my network was thankfully on the internet, and I don't plan to get offline anytime soon. I have spoken to many folks who have built a tech career and are now setting up their angel operations in Miami. Many of them are second-generation Latinos and figure that their lasting legacy is to invest in companies' next-generation while delivering above-average returns. Privately, I have spoken to executives and tenured employees who felt it was untenable to raise a family where they couldn't buy a home and were essentially forced to enroll in a private school if they wanted good outcomes for their children.

Since I moved back in 2018, I have seen a slow expansion of ever knowledgeable angels and firms open shop. Community leaders like Monica Black, Austen Bunsen, Brian Breslin, and Raul Moas are faithful stewards of the tech and venture community. I am sure their continued engagement will bear more fruit. However, Florida's geography and transportation infrastructure have everything a little spread out. Investments in Tri-Rail, Brightline, SunRail, and the Metrorail will also become a suitable alternative to driving and will metaphorically bring people closer together when it's time.

Prior Wins and Successes

There are bright spots in the state's recent history. PetSmart acquired chewy in 2017 to the tune of $3.35 billion; Chewy was able to take advantage of Oceola as a major distribution center for its logistic operations. Rony Abovitz is a two-time founder. His first exit MAKO Robotics sold to Stryker for $1.65 Billion in 2013- not to mention his second attempt with Magic Leap despite his departure from the company. Recently, Luminar Technologies- a startup that supplies LiDAR devices has a significant hardware presence in Orlando. Luminar will be going public via SPAC for $3.4 Billion.

There is also hope with wooing existing large corporates. AMD and Apple taken advantage of defense contractors' employees looking for greener pastures in Orlando by opening hardware development offices.

In Miami, Spotify has plans to open a new office at The Oasis in Wynwood, an area that owes its success to eccentric billionaire Moishe Mana. Elsewhere, SoftBank opened an investment office, and it's the home of WeWork CEO and Masa Son's lieutenant-Marcelo Claure. Marcelo is best known for engineering the turnaround at Sprint while preparing for its merger with T-Mobile. Son and Claure initially met with Claure's initial cellular venture of Brightstar, where SoftBank took a $1.26 billion stake. Not to mention that there is a roster of companies finding growth despite the pandemic like Papa, WhereByUs, and NearPod.

City of Miami Mayor Xavier Francis Suarez's tweet welcoming Keith Rabois reflects Floridian politicians' willingness to keep up the charm offensive in attracting businesses and HWIs to the state. Likewise, in Central Florida, representatives who serve Osceola county Florida, have continuously engaged with UCF and South Korean multinationals to develop Orlando. As the US is ravaged by cost disease, local and state governments have an open shot at California's economic growth monopoly. And I think Florida has a pretty good shot compared to others. In my experience, Floridian politicians on both parties love to see new jobs in the state, and for many companies looking to move: each city's chamber of commerce is always willing to go to bat.

The new arbitrage is quality of life. As for Florida, the fate lies in the state's hands and its inhabitants. Founders can rest assured that there is a new shop in town making deals- but wealthy inhabitants don't make a city or a state. It's the willingness of its people to found companies, engage, and invest.

Hey Angelo here! If you liked this post consider sharing and subscribing. I do appreciate serendipitous discussions around ramblings of all kinds, my DMs are open on Twitter over at @ndneighbor

It’s a rough world out there, let’s remind ourselves to be kind and charitable to one another.

Special thanks to Turner Novak, Ali, Joel Montano, Shreya Sudarshana, and Regynald Augustin for reviewing early drafts of this letter.